"I have to say using Aaron Wallis Recruitment has been nothing but an absolute pleasure. I've used many agencies over the years as the client and the candidate and its not always been a pleasurable experience! My consultant George Humphries has been an absolute star"

Lee Knowles

Company Car or Car Allowance?

Company Car, Car Allowance or Mileage Allowance – what is better?

The ultimate guide to company car benefits for employees and employers

In this Guide:

Choose from one of the sectors below for further information

by clicking the following icons:

What is a car allowance?

Some business roles require the use of a vehicle more than others, and field sales is undoubtedly one of those. Your sales teams will be out and about following up leads and servicing existing clients much of the time, so you’ve got to figure out the most cost-efficient and beneficial way for them to do so.

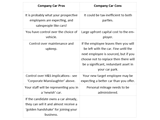

There are three standard options available: a company car, a company car allowance, or a mileage allowance. There are pros and cons to each, including tax implications. Every case and individual preference of both employer and employee is different for a myriad of reasons.

Logic will prevail in most cases. For example, if you’re recruiting for an experienced field sales professional, the chances are they will have enjoyed a company car or received a car allowance in their previous role. It’s likely, therefore, that they would be looking for the same deal within the package you’re offering.

Offering a company car

Handing over a company car doesn’t end with you buying it and presenting the employee with the keys. Your business will still be responsible for ongoing repairs, MOTs (after three years old) and servicing. You’ll also be liable for vehicle insurance, driving costs (since your employee will still claim a mileage allowance to cover petrol), and the need to sell the vehicle when it reaches a certain age (or the employee leaves).

Most companies then operate a ‘fuel card’ where the fuel is paid by a credit facility at the pump, invoiced by the ‘fuel card operator’ to the employer, paid by the employer and the employee pays a contribution towards the fuel for their own personal usage. Alternatively, although rare, some get their sales team to expense all fuel and then claim back the receipts after deducting an amount for their own private fuel.

Tax implications for the employer (as of March 2024):

Providing a company car has tax implications for your business:

- Class 1A National Insurance: You must pay National Insurance contributions (NICs) on the benefit's value for the employee.

- VAT reclaim on fuel costs: You can reclaim a portion of the VAT paid on fuel the employee claims back for business mileage. However, this is subject to the employee keeping proper records and providing valid VAT receipts.

- Capital allowances: You can claim capital allowances for the cost of purchasing a company car. The rate depends on the vehicle's CO2 emissions, with zero-emission vehicles offering the highest allowances.

Leasing vs. purchasing:

- Leasing: If you lease the company car, you can only claim back 50% of the VAT on lease payments.

- Purchasing: For 100% VAT reclaim, the vehicle must be used solely for business purposes with minimal personal use.

Additional notes:

- Double-cab pickup trucks will be classified as company cars from July 1, 2024, which may affect their tax treatment for employers.

- Consider seeking professional advice from an accountant or tax advisor for specific guidance regarding your company's situation and claiming strategies.

Tax implications for the employee (as of March 2024):

Receiving a company car is considered a benefit in kind, meaning employees are liable to pay income tax and National Insurance on its value. This tax is deducted through PAYE (Pay As You Earn) if the employer notifies HMRC (Her Majesty's Revenue and Customs) beforehand. The amount of tax owed depends on two factors:

- The type of vehicle: Company car tax rates are based on the vehicle's CO2 emissions, with zero-emission vehicles (electric cars) currently having the lowest rates. You can find the latest company car tax rates on the GOV.UK website: [invalid URL removed].

- The P11D value: This is the official valuation of the car for tax purposes and is typically based on its list price and CO2 emissions.

Mileage allowance:

Employees with company cars can still claim a mileage allowance for business journeys, but the amount no longer depends on the engine size as of April 6, 2023. The current rates are:

- 45 pence per mile for the first 10,000 business miles driven in a tax year

- 25 pence per mile for each subsequent business mile

It's important to note that these are the advisory rates from the government, and employers have the discretion to set their own mileage allowance policies.

Additional notes:

- Double-cab pickup trucks will be classified as company cars from July 1, 2024, which may affect their tax treatment for employees.

- These are general guidelines, and it's always recommended to consult with an accountant or tax advisor for personalized advice regarding your specific situation.

Other benefits

There are further benefits for the employee – they get a new car every few years, and they don’t have to worry about maintenance or servicing costs.

However, employers must also be aware of the Corporate Manslaughter and Corporate Homicide Act 2007, which makes it easier for the families of victims to make a claim against organisations if they are found to be negligent in the upkeep of the vehicle, or the driver is deemed to be careless. The fines appropriated are unlimited and apply to both companies operating company cars or employees driving their own car on behalf of your business.

As a minimum action point from this advice, you must ensure that your company meets the required health and safety regulations and has a regularly reviewed policy on using cars for company business to ensure that you are adhering to changing laws. To find out more, the HSE has several guides for safe driving at work.

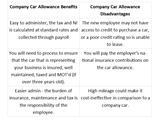

A company car allowance

If your staff require a vehicle, an alternative is to offer a company car allowance which is added to their salary and paid monthly.

Receiving a company car allowance gives your staff the means to either lease their vehicle or buy one outright, using the allowance funds to pay for a loan. Rather than being presented with a make or model of your choosing, they can select whatever car they like, new or nearly new. Of course, they are then responsible for all insurance and maintenance costs and replacing the vehicle when it becomes economical to do so. Keep in mind your staff should have a private car that looks good and won’t embarrass your business when it’s out on the road, and most companies have some kind of policy such as the vehicle must be less than five years old or ‘no soft tops’.

You, as a business owner, can decide how much the car allowance should be and include it in the employee’s contract. Based on an average of projects worked by Aaron Wallis, we suggest that benchmark figures, should be:

- £8,200 to £10,300 for Sales Directors, Commercial Directors and Business Unit Directors;

- £6,500 to £8,200 for Senior Sales Managers;

- £4,800 to £6,500 for Sales Managers;

- £4,200 to £4,800 for Business Development Managers;

- £3,600 to £4,200 for Field Sales Representatives.

As their employer, you will pay tax and national insurance on the car allowance at their normal rate as part of their salary, making the tax elements for both parties much more straightforward than operating a company car.

Most companies then pay a mileage allowance on top of the car allowance, which is claimed via expenses.

Anyone potentially driving more than 25,000 miles a year for business should consider opting for a company car because the ‘wear and tear’ and depreciation costs of this substantial mileage are unlikely to be met by the reducing mileage rate.

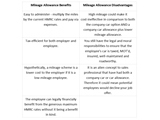

Mileage Allowance rate only

For many sales employees using a car is not usually part of their daily routine. However, occasionally they may be required to use a vehicle – perhaps for an ad hoc meeting, to drop off some samples or for an annual service meeting.

It makes no sense for an employee of this type to receive a car allowance, even less so a company car. However, they still need to be reimbursed for using their vehicle for work. In this case, they can claim the normal mileage rate (45p/mile up to 10,000 miles, 25p thereafter at current HMRC rates) without any tax implications. It’s up to the employee to make sure their insurance covers use for work, and you, as the employer, should have the insurance certificate on record. If the employee doesn’t have valid insurance for work then the employer should make a company vehicle, or hire car, available.

For the employee, this scheme can also be quite lucrative as the fuel required per mile and a contribution to the ‘wear and tear’ is unlikely to be above 20p per mile. Therefore, under current HMRC rules the employee can profit by up to 25p per mile for using their car, and it is not classed as a ‘benefit in kind’.

What about company vans?

There may be tax benefits for getting a company van rather than a company car. However, this must be job-related – your vehicle must be built for carrying goods or burden. Fully laden, the gross vehicle weight should not exceed 3,500kg. Work buses or minibuses do not count as vans, but double-cab pickups can be, which is currently making them an increasingly popular option as a company car. The bonus of a van for the employee is that everyone starts with the same fixed rate of tax, which might reduce under certain conditions. If the van is used for the employee’s commute to/from work there are likely to be further tax implications.

Do you pay National Insurance on a Car Allowance?

National Insurance (NI) is currently applied to almost all types of income, including, in most cases, car allowances.

Car allowances are typically paid as part of an employee's salary or wages. While it may be shown on a separate line on a payslip, it is still deemed as ‘income’, and therefore NI is applied.

It is also vital to detail that in this circumstance, Employer’s National Insurance Contributions (ENICs) will also apply.

Exceptions to paying National Insurance on a Car Allowance

You will need to speak to an accountant for current guidance, but if the car allowance meets certain conditions and is paid as a separate, standalone benefit, it may not be subject to NI. A current example in 2023 could be a liveried van with the company logo.

For up to date and valid information about the tax implications of a car allowance, it is recommended that you consult with a tax professional or seek guidance from HM Revenue and Customs (HMRC).

Points to Consider

Check before you buy

The rule of thumb for employers and employees is to check on the tax implications and benefits of any form of a company vehicle, company car allowance or mileage benefits. Different vehicles and the amount of usage will change from person to person. What’s beneficial for one will not be for another, and the government offers a useful company car calculator for speedy comparison.

Long-Term Car Hire

Many new employees will be nervous about taking on a long-term car lease. We have had many candidates that have always had company cars and are looking to join a company that solely offers car or mileage allowances.

Understandably they do not want to commit to a three-year lease contract which typically has significant penalties for breaking contract.

In this instance many of the traditional car rental firms, such as Europcar, Thrifty and Easycar, offer three or six-month contracts. Obviously the employee will pay a weighty premium for this that typically erodes all of a car allowance but does de-risk the situation in the short-medium term until the employee has passed their probation.

Finally

There is not a ‘one size fits all’ solution, and in some instances, a mileage allowance is better for both the employer and employee.

However, usually, a company car or car allowance is better for both parties if the expected mileage is going to be over 6-8,000 or so business miles per year. Also, a company car, or allowance, allows some control over both health and safety issues and the type of car that is used to represent your business. A car or car allowance can also be the benefit that clinches your perfect candidate.

We hope that this quick guide, in conjunction with the appropriate links to HMRC and HSE advice, provides you with the information to make the best decisions for your own individual company’s situation.

Video Roundup

Watch a video summary on the decision from the Managing Director of Aaron Wallis, Rob Scott.

Date published: 26th Feb 2024

Submit your CV

Take the first step towards your new role today

Search jobs

With hundreds of jobs available, now is the time to look for your perfect position

by Sam Childerley

Recruitment Consultant

About the author

Sam Childerley

Sam Childerley is a Business & Marketing professional who started his recruitment career in 2021. He is a specialist recruitment consultant, who operates across in the UK and is based out of our Milton Keynes Office. Sam is dedicated to helping job seekers and employers find the right fit for each other and believes that the best decisions within recruitment are made when both sides are happy. He is passionate about developing the best possible recruitment experience for everyone involved and is committed to providing the best advice and support to employers and job seekers alike.

Please call us to discuss your next move

From our blog

Read moreOur employers say...

Our candidates say...